Our Thinking

Our Thinking

FREE WEBINAR: Monetising the Customer Experience

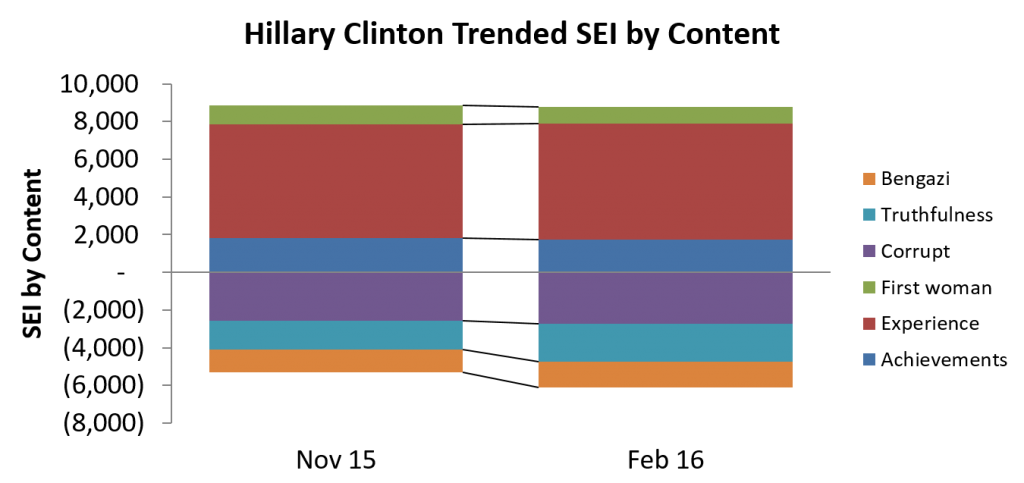

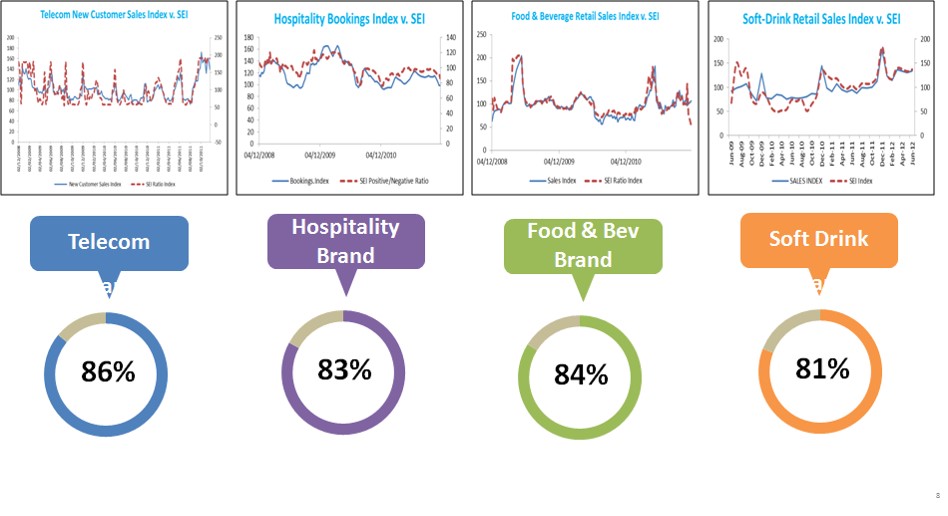

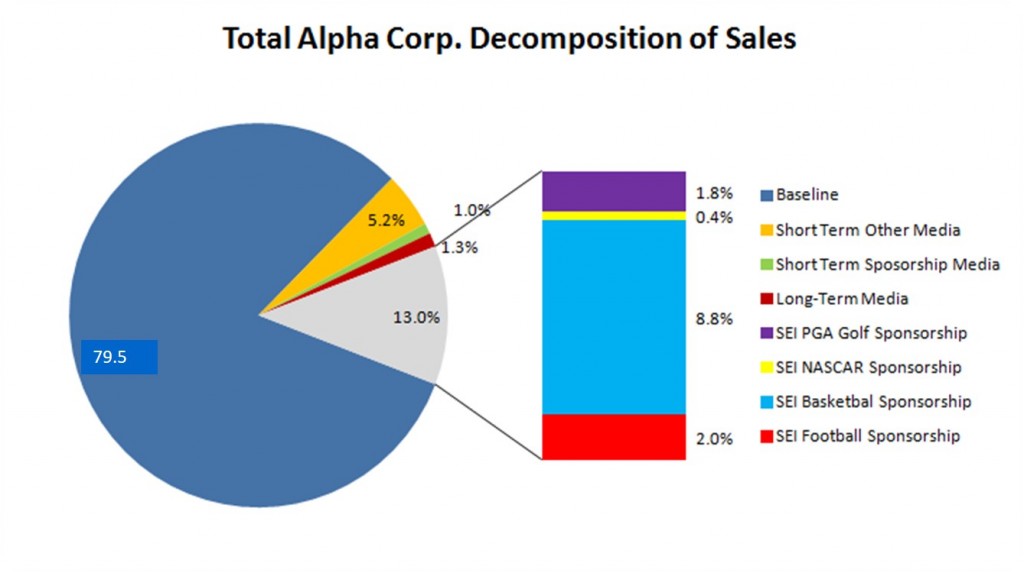

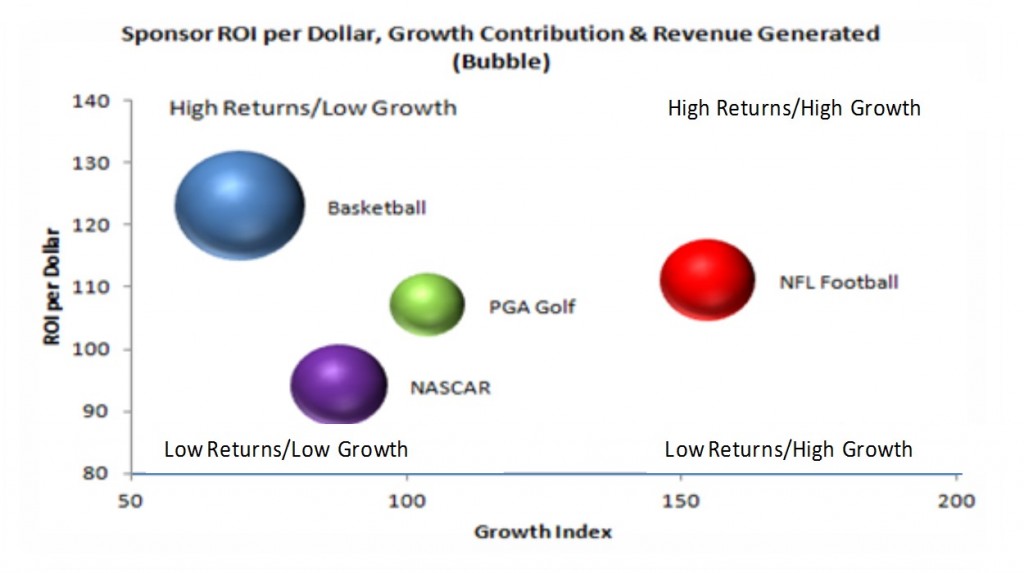

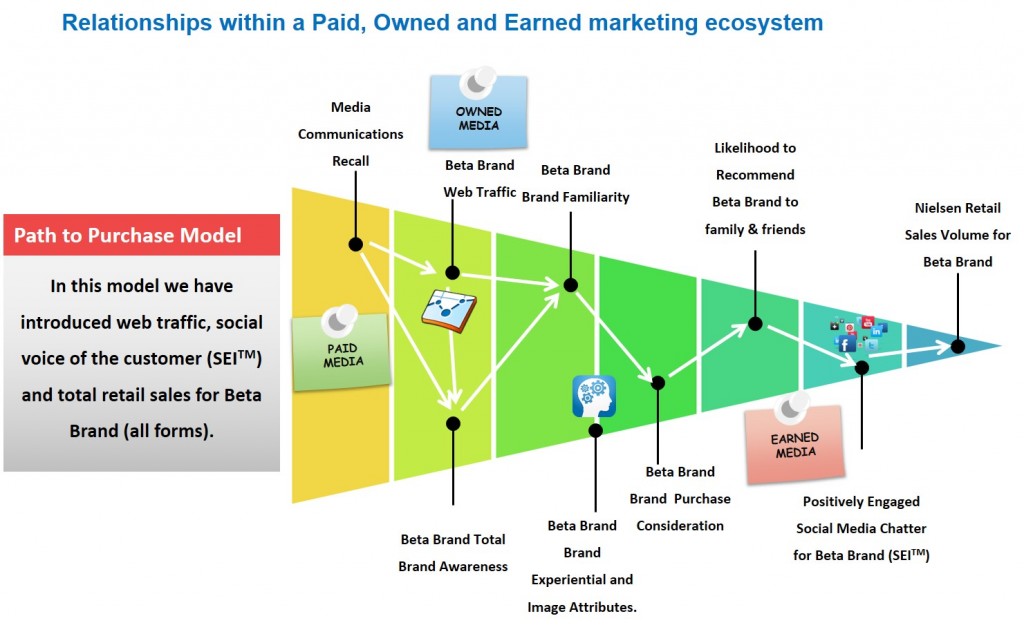

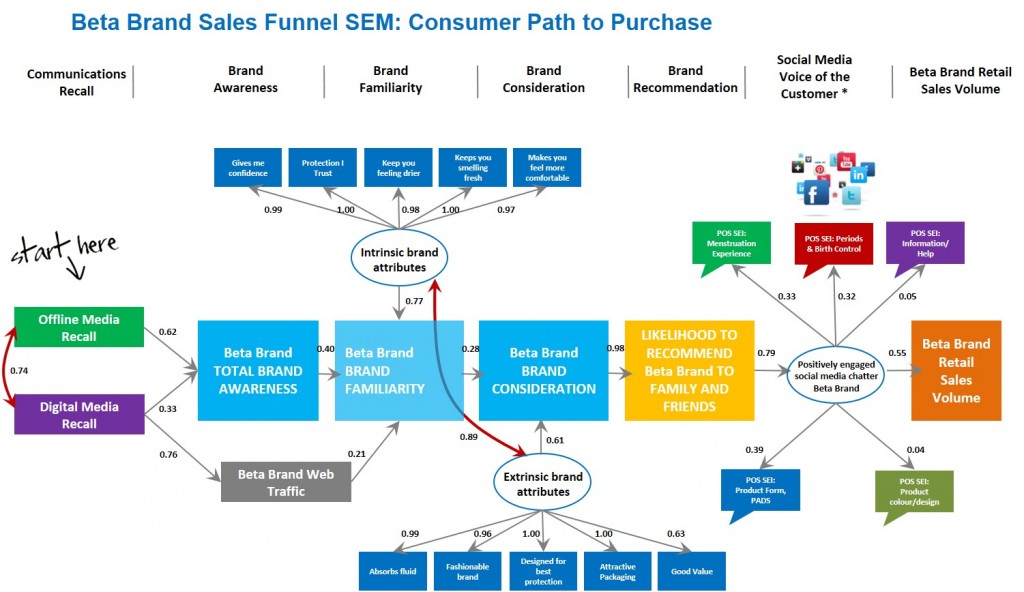

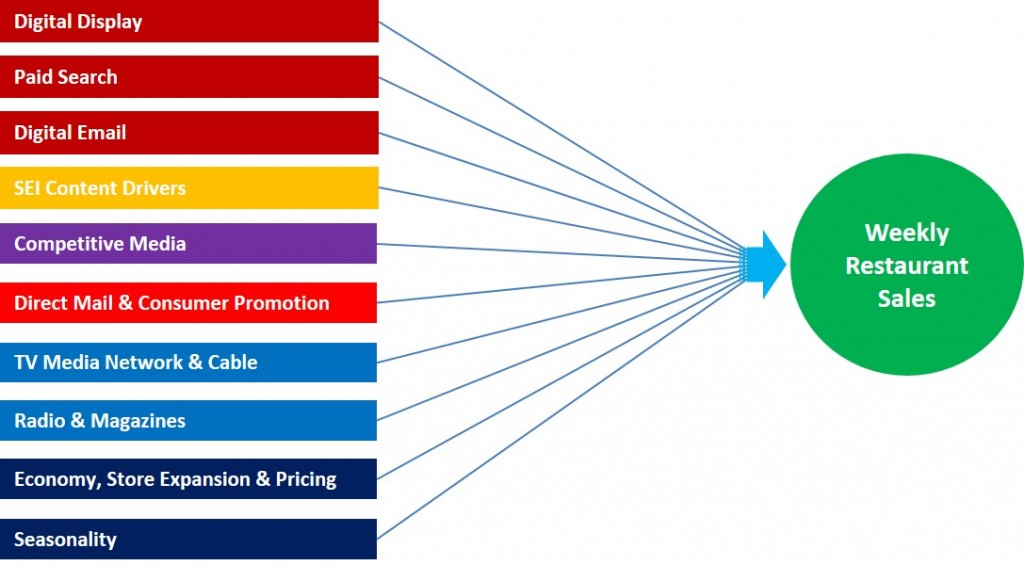

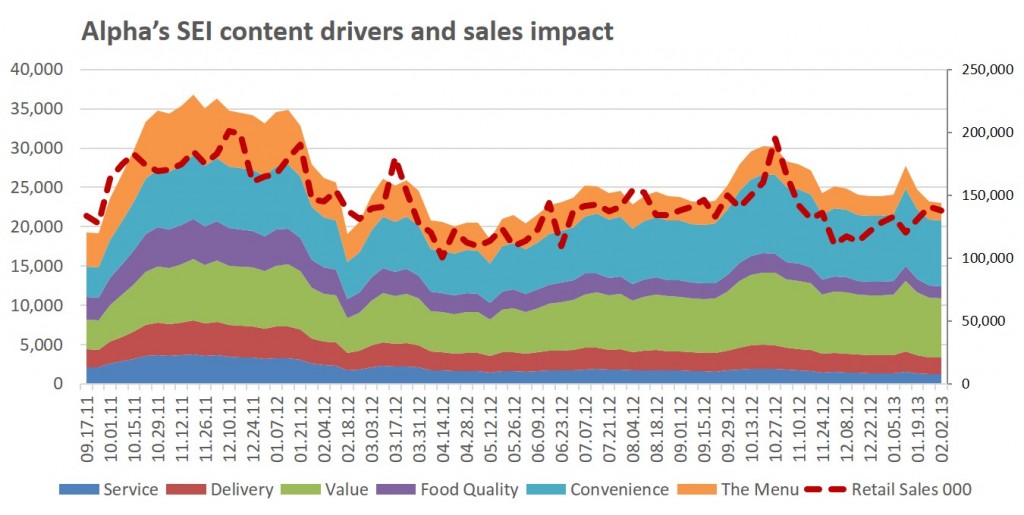

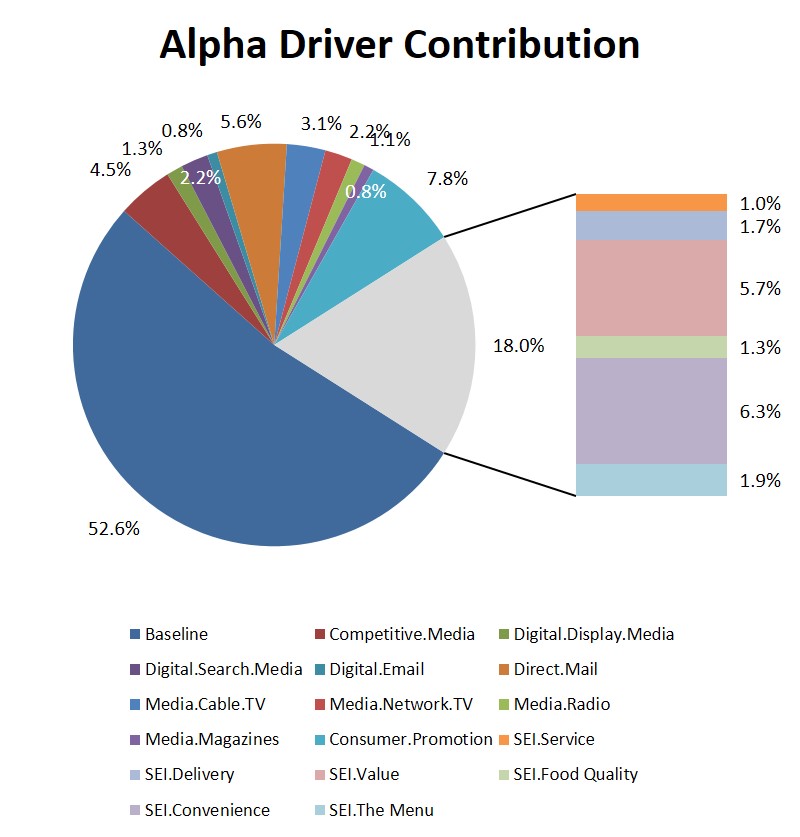

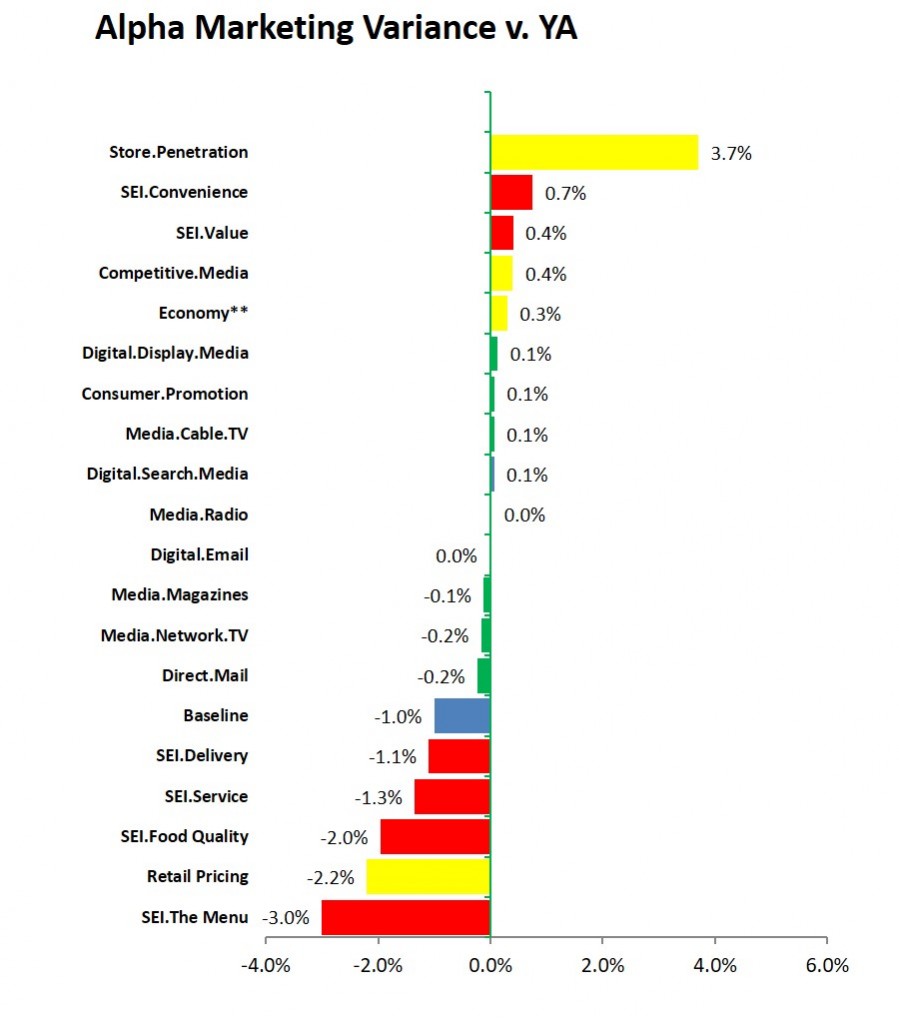

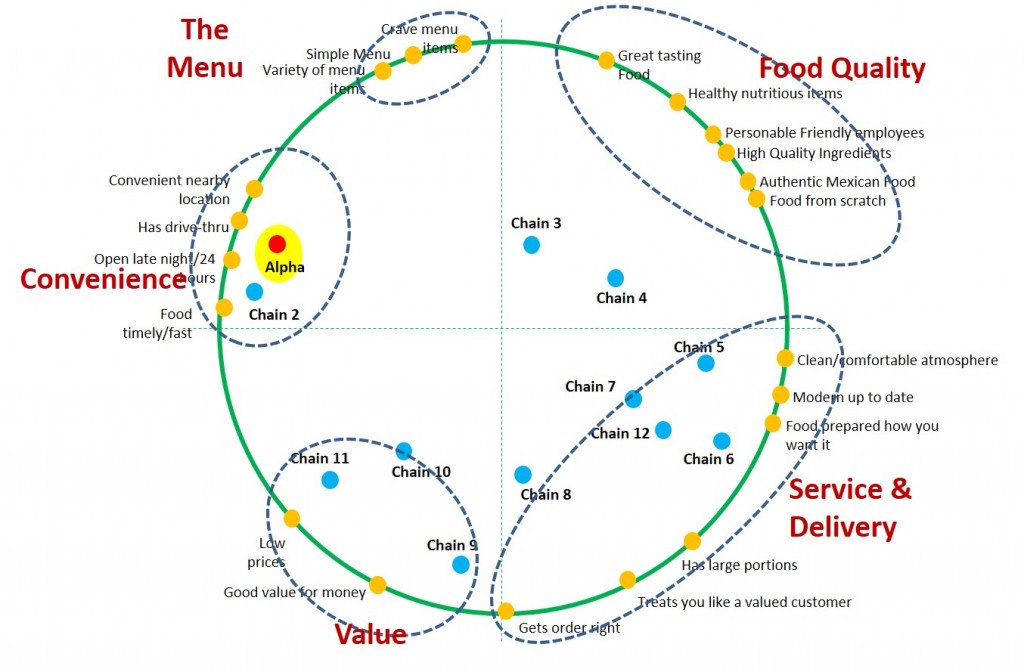

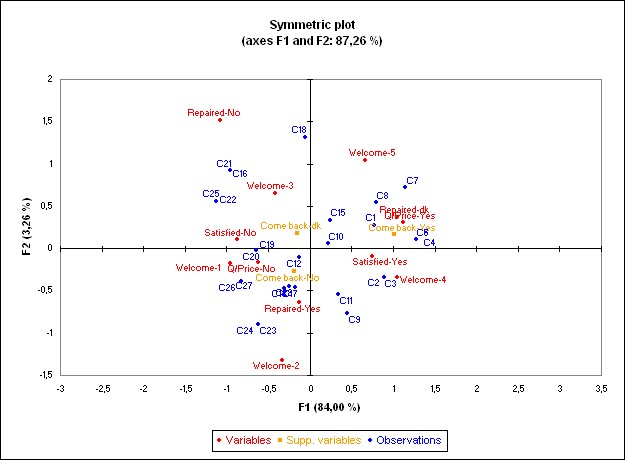

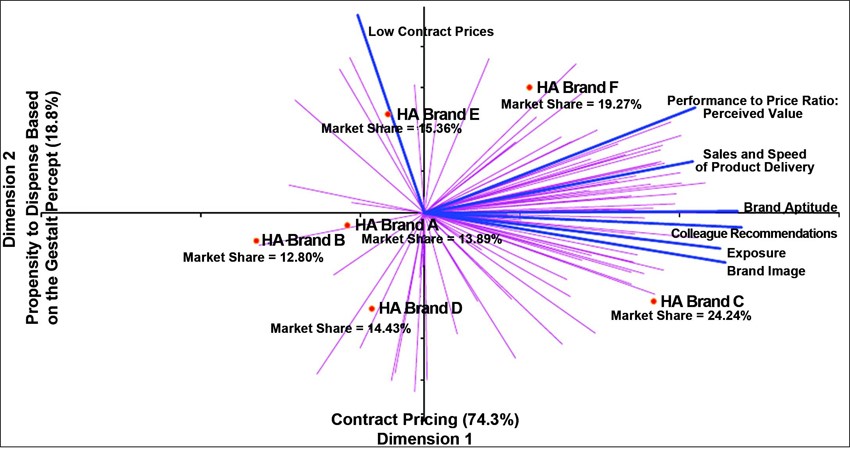

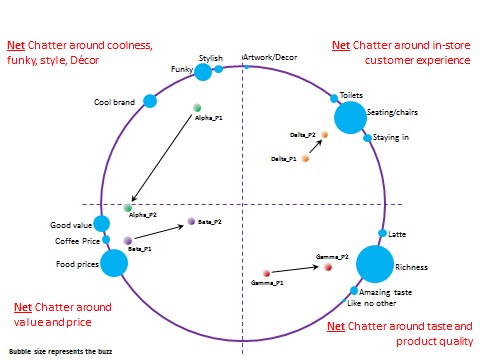

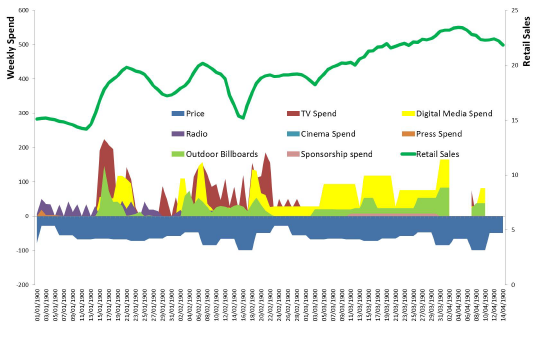

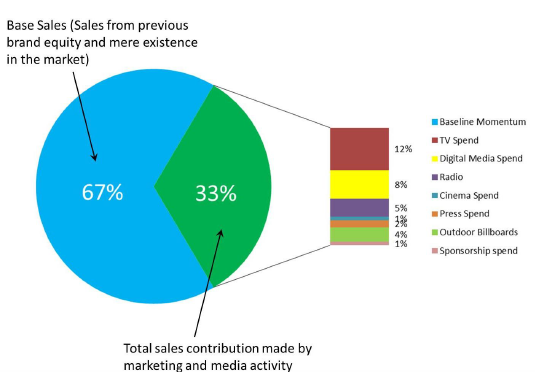

Social media is a rich source of commentaries on the Customer Experience. If this data could be turned into a relevant metric, with all its rich content, it could revolutionize brand insights and bring them to a stronger and more informed connection with customers. BLA has developed an approach which converts text into a powerful metric that when packaged inside a media effectiveness model allows us to determine it’s impact on hard sales.